In the past decade, solar photovoltaic (PV) systems have increased worldwide. The rise of PV is attributable to many factors, most notably the dramatic decrease in the cost of solar PV modules. Increasing the number of PV systems requires effective solar asset management (SAM). SAM is a relatively new field that encompasses all aspects of operating and maintaining a portfolio of solar PV assets. This article will provide an overview of SAM, including its benefits, key players, and challenges. We will also outline some of the best practices for SAM in 2022 and beyond.

Related article: The Top 10 Essential Asset Management System Requirements in 2022

What is Solar Asset Management?

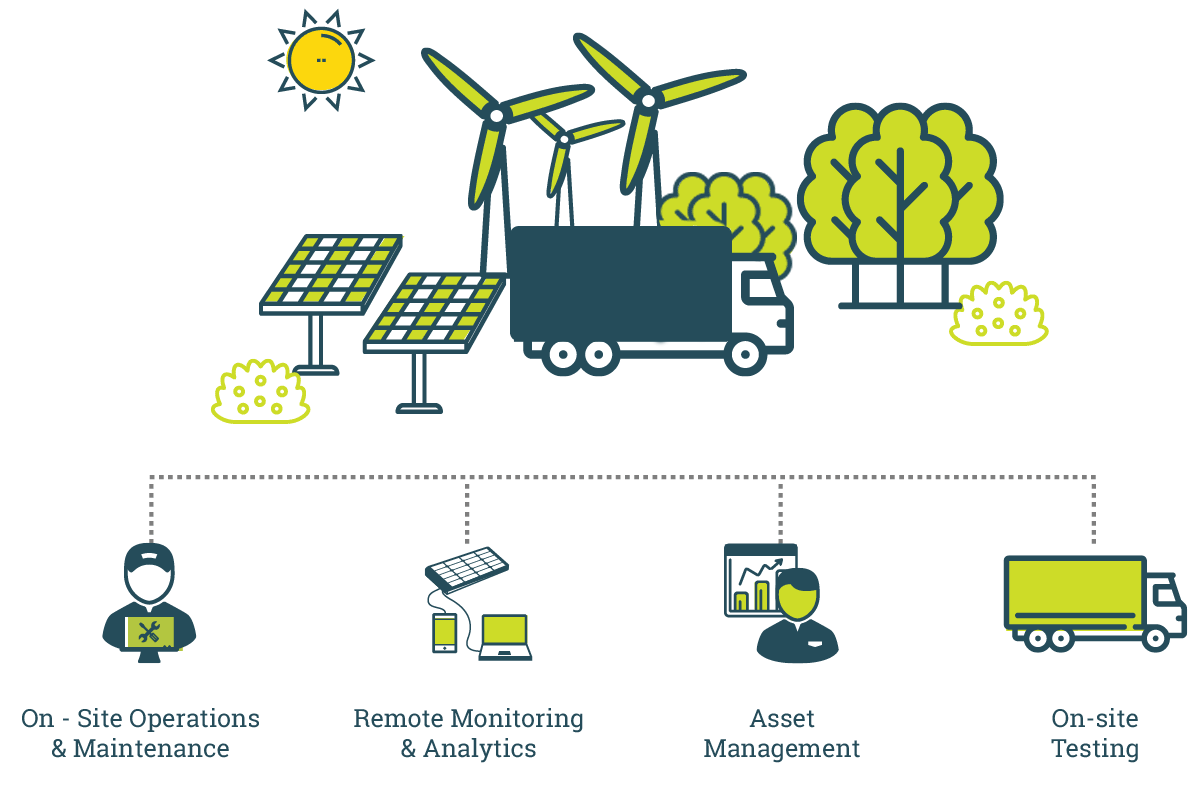

Solar asset management is the proactive and continuous process of operating, monitoring, and maintaining solar photovoltaic (PV) systems to ensure they perform at or above their expected levels.

Solar asset management aims to maximize the financial return on investment (ROI) for PV system owners. This is done by optimizing energy production and reducing operational and maintenance costs, which also extends the lifespan of PV equipment.

Solar asset managers use data analytics to monitor PV system performance in real-time to achieve these goals. It allows issues to be identified sooner and corrective measures to be taken quicker. Solar asset managers also work with PV system owners and other stakeholders to develop long-term strategies for maximizing ROI.

Basics to consider for solar asset management

When it comes to solar asset management, there are a few basics that you need to keep in mind. Here are a few things to consider:

- The lifespan of your solar panels is a key factor. Solar panels typically have a lifespan of 25-30 years. However, this can vary depending on the panels’ quality and the conditions they are subjected to. It is essential to factor in the lifespan of your solar panels when making decisions about your solar asset management strategy.

- The condition of your solar panels is an integral part of SAM. Solar panels can degrade over time due to weathering, dirt, and other factors. It is imperative to regularly inspect your panels and clean them as needed to ensure they are operating at peak efficiency.

- The output of your solar panels impacts your SAM strategy. The output of your solar panels will decrease over time as they degrade and lose efficiency. This is why it is essential to monitor your system’s production and make adjustments as necessary to ensure you are getting the most out of your investment.

- The cost of maintenance and repairs should be considered. As with any type of equipment, solar panel systems require regular maintenance and occasional repairs. It is vital to factor these costs into your overall solar asset management strategy so you can budget accordingly.

Why is Solar Asset Management important?

Solar Asset Management (SAM) is crucial for several reasons, chief among them include:

- SAM helps maximize a solar project’s financial return on investment (ROI).

- SAM can ensure the long-term performance and reliability of a solar project.

- SAM can reduce the risk of financial losses associated with solar projects.

Improved ROI

The financial return on investment from a solar project is directly related to the performance of the solar asset. Solar panels degrade over time and lose their efficiency. To maximize ROI, it is important to monitor and manage the performance of solar assets throughout their lifetime. It includes regularly cleaning and maintaining the panels, monitoring output, and troubleshooting any issues that may arise.

Performance and reliability

A solar project’s long-term performance and reliability depend on proper asset management. It is important to monitor critical parameters such as module power output, energy yield, system availability, and so on, to ensure that a project continues to perform as expected over its lifetime. Additionally, it is essential to have a plan in place for routine maintenance and repairs and to deal with unexpected problems that may occur.

Reduced risk with regular monitoring

Effective asset management can help reduce the risk of financial losses associated with solar projects. By regularly monitoring key parameters and taking proactive steps to address any issues that may arise, it is possible to minimize the likelihood of costly repairs or replacements being necessary. Additionally, we can reduce the time that a project may be offline due to unforeseen issues.

Ensure compliance

SAM is also helpful in complying with regulations. Several government incentives and regulations relate to solar PV systems, so it’s important to stay up-to-date with them. A good asset management strategy will ensure you meet all the requirements for your system, such as staying up-to-date with any changes in regulations. That way, you’ll always be in compliance and avoid penalties.

Improving solar asset management

To improve solar asset management, there are a few key areas that need to be addressed.

- First, it is vital to have a clear and concise understanding of what assets are owned and operated by the company. This includes solar panels and inverters and contracts and licenses.

- Second, the company needs to develop robust processes for tracking and monitoring the performance of these assets. This data can then be used to identify opportunities for improvement and optimize the operation of the solar asset portfolio.

- Finally, it is critical to have an effective system in place for maintaining and repairing solar assets when necessary. This system should be designed to minimize downtime and maximize the efficiency of the solar asset fleet.

Final note

Modern-day businesses need to break tradition and embrace an evolving new way of working. Current linear management approaches are inefficient, leading to mistrust and a lack of transparency among teams. Businesses that want to succeed need a more fluid, flexible system that is focused on achieving goals. And the focus must be on an asset-centric and information-based management approach, which will let the main stakeholders view the same data set and make decisions based on factual and valid information.

FAQs

What type of asset is a solar system?

A solar system is a long-term investment; as such, it is essential to understand the different types of solar systems to make the right decision for your needs. The three main types of solar systems are:

- On-grid systems: These are connected to the utility grid and allow you to sell any excess power back to the grid.

- Off-grid systems: These are not connected to the utility grid and require batteries to store excess power for later use.

- Hybrid systems: These are a combination of on-grid and off-grid systems, typically with batteries, that offer the best of both worlds by allowing you to sell excess power back to the grid while also having a backup power source in case of an outage.

What are solar assets?

Solar assets are solar panels and solar inverters that are used to generate electricity from sunlight. Solar asset managers are responsible for ensuring that these assets are operated and maintained to maximize their performance and lifespan.

Solar asset management includes activities such as monitoring the performance of individual assets, scheduling maintenance and repairs, and managing financial risks associated with the ownership of solar assets. It is a critical part of ensuring the long-term viability of any solar energy project.

The first step in effective solar asset management is understanding the different types of solar assets and their key characteristics. Solar panels and inverters are the two main types of solar assets, and each has its own unique set of performance metrics that need to be monitored.

Solar panels convert sunlight into electricity, while inverters transform the direct current (DC) output of panels into alternating current (AC) that households and businesses can use. Solar panels come in various shapes, sizes, and efficiencies, so it is important to select the correct type of panel for each installation. Inverters also come in different types with varying features and capabilities.

When it comes to monitoring solar asset performance, there are a few key metrics that should be tracked regularly:

- Electricity production: This measures how much electricity is being generated by the asset on a daily or monthly basis.

- Efficiency: This measures how well the asset is converting sunlight into electricity.

- Operating temperature: This measures the temperature of the solar panel or inverter during operation.

- Power output: This measures the maximum amount of electricity the asset can generate under ideal conditions.

Solar asset management also involves regularly scheduled maintenance and repair tasks to keep assets in good working condition. These tasks can include cleaning solar panels, replacing damaged parts, and troubleshooting problems with equipment.

In addition to physical assets, solar asset managers also need to be aware of the financial risks associated with owning and operating solar energy projects. These risks can include changes in government incentives, fluctuations in electricity prices, and the possibility of equipment failure.

Solar asset managers need to have a strong understanding of the technical aspects of solar energy systems and the financial risks involved to succeed.

Related article: How may Infraon assist your company with an effective ITSM integration?

How do you value a solar asset?

Assuming you are looking to purchase a solar asset, there are a few key things you need to consider in order to value the asset:

- How much money will the solar asset generate? This is crucial in determining the value of the solar asset. You need to consider not only how much energy the system will produce but also how much that energy will be worth based on electricity prices in your area.

- What are the long-term maintenance costs associated with the solar asset? Solar panels and other equipment will require periodic maintenance and replacement over time, so you must factor those costs into your calculations.

- What is the expected lifespan of the solar asset? Knowing how long you can expect the system to produce power before needing replacement can help you better estimate its overall value.

- Are there any government incentive programs available for this particular solar asset? Some states and localities offer tax breaks or other financial incentives for investing in renewable energy, so be sure to check if these programs apply to your situation.