Is it accurate that the loan application process involves a thorough evaluation by lending institutions to assess borrowers’ creditworthiness? Based on this assessment, do lenders decide whether to approve or decline loan applications?

Does this complex process frequently encounter challenges, resulting in lengthy processing times and a higher risk of inaccuracies? This blog provides insights into how ITSM aids in assessing borrowers’ creditworthiness within the loan application process and addresses the associated challenges.

The emergence of IT Service Management represents a transformative solution that has effectively transformed the credit approval process. It has introduced streamlined processes and procedures, significantly enhancing the productivity and accuracy of the loan application process. This technological advancement has streamlined the complexity of loan application processing.

Related blog: Fraud prevention and detection: ITSM’s role in banking security

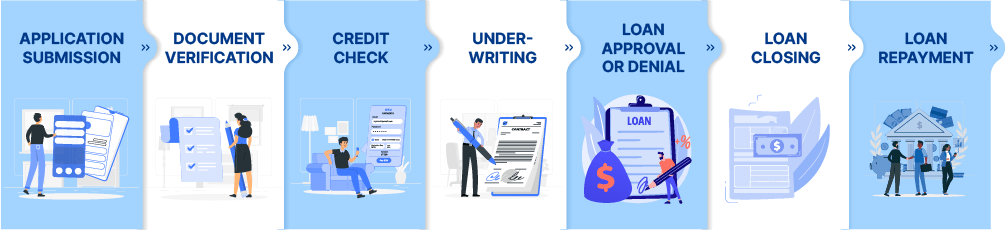

The 7 Essential Steps in the Loan Application Process

The loan application process is a structured sequence that borrowers navigate when seeking financial assistance. These seven stages are the backbone of a thorough and professional approach to lending, facilitating informed decisions, and ensuring a transparent and compliant process.

- Application Submission: The process commences with borrowers submitting their applications, which encompass vital personal and financial details, desired loan amounts, and a delineation of the intended utilization of funds.

- Document Verification: Lenders embark on document verification, encompassing income verification, scrutiny of bank statements, and a comprehensive examination of identification documents, thus ensuring the accuracy and completeness of submitted information.

- Credit Check: A comprehensive credit check evaluates the applicant’s creditworthiness. It includes a detailed analysis of credit history and the assessment of credit scores to gauge the level of credit risk.

- Underwriting: The central pillar of decision-making underwriters, as the linchpin of the loan approval process, evaluate various aspects, including income stability, employment history, credit history, and debt-to-income ratios. Their evaluation leads to decisions on loan approval, accompanied by the specification of precise terms or the communication of clear reasons for the denial.

- Loan Approval or Denial: This stage represents the culmination of the decision-making process. Lenders provide borrowers with the verdict, either offering loan approval with the associated terms and conditions or articulating the rationale behind a denial.

- Loan Closing: Borrowers and lenders engage in a formal closing process. During this stage, agreements are finalized, essential documents are signed, and funds are disbursed, marking the official commencement of the loan agreement.

- Loan Repayment: The final stage of the process commences as borrowers dutifully adhere to the agreed-upon repayment schedule, encompassing both the principal amount and accrued interest. This stage is crucial for ensuring the successful fulfillment of the financial commitment.

Each of these seven stages plays a vital role in safeguarding the interests of both borrowers and lenders, fostering responsible lending practices, and ensuring regulatory compliance within the professional landscape of the lending industry.

Related blog: How Zero Trust helps banks overcome the biggest challenges of digital transformation

Introduction to ITSM in Loan Application Processing

ITSM ensures that the technology infrastructure and IT services supporting credit approval are highly efficient and maintain robust security measures and strict compliance with the intricate web of industry regulations. This creates a streamlined, secure, regulation-compliant loan application process for borrowers and financial institutions.

The Role of ITSM in Loan Application Processing

ITSM streamlines the loan approval process by optimizing workflows, automating routine tasks, and resource optimization. Moreover, ITSM emphasizes cybersecurity, safeguarding sensitive financial data, and ensuring data integrity throughout the application lifecycle.

Additionally, ITSM helps organizations navigate complex compliance requirements in the highly regulated financial sector, such as those mandated by the Gramm-Leach-Bliley Act (GLBA) and the Consumer Protection Act. Continual improvement ensures that the loan processing operation remains responsive to evolving business needs and customer expectations.

Unlocking the Benefits of Implementing ITSM in Credit Approval

Credit approval is a critical process within the dynamic environment of financial services. Let’s explore how ITSM revolutionizes credit approval, benefiting financial institutions and borrowers.

- Streamlined Operations: ITSM streamlines credit approval workflows, creating a more fluid and organized process. This leads to smoother and more predictable operations, reducing bottlenecks and unnecessary delays.

- Elevated Service Quality: By establishing precise service levels and performance metrics, ITSM ensures that credit approval services consistently meet or exceed customer expectations. It results in a higher standard of service quality, enhancing customer satisfaction and trust.

- Proactive Risk Mitigation: ITSM takes a proactive approach to managing risks. It identifies potential issues, such as errors, fraud, or security threats, before they can disrupt the credit approval process. This proactive stance minimizes the likelihood of operational disruptions and financial losses.

- Cost Savings: ITSM helps organizations optimize their use of resources by automating repetitive tasks and improving resource allocation. This optimization reduces operational expenses and resource wastage, leading to financial savings.

- Regulatory Adherence: ITSM aids organizations in maintaining compliance with intricate regulatory requirements in the lending industry. It ensures that every aspect of the credit approval process aligns with relevant laws and regulations, reducing the risk of legal complications and penalties.

- Enhanced Customer Experience: ITSM enhances the borrower’s journey by providing intuitive interfaces, organized communication channels, and rapid issue resolution. This overall improvement in the customer experience fosters greater satisfaction and loyalty among borrowers and credit officers.

These benefits underscore the value of ITSM in credit approval processes that ultimately benefit financial institutions and their customers.

How ITSM-Integrated Automation Streamlines Credit Application Processing

Integrated with ITSM, automation revolutionizes credit application processing, elevating accuracy and borrower convenience.

- Optimization: Through automation, ITSM accelerates credit application processing by replacing manual, time-consuming tasks with automated workflows. Tasks like data entry, document verification, and even initial credit scoring can be automated, significantly reducing processing times.

- Accuracy: Integrated automated systems execute repetitive tasks with exceptional precision, effectively minimizing the risk of errors and inconsistencies in credit application data.

- Consistency: Automated processes, guided by predefined rules and criteria, ensure the uniform evaluation of credit applications. This consistency reduces the potential for bias or human error.

- 24/7 Availability: Automation extends credit application processing to a 24/7 operation, enabling borrowers to submit applications and receive responses beyond regular business hours, enhancing customer convenience.

- Scalability: Integrated ITSM and automation systems readily adapt to fluctuations in loan application volumes, proficiently scaling to accommodate increased workloads without requiring extensive manual intervention.

The Use of Workflow Management Tools in ITSM

Workflow Management Tools in ITSM have become integral for modern organizations. These tools drive the success of IT Service Management. This discussion delves into their role and their transformative impact on ITSM practices.

- Process Design: These tools allow organizations to design, customize, and visualize the end-to-end credit application process. Workflows can be tailored to align with specific lending criteria and regulatory requirements.

- Task Assignment: Workflow management tools assign tasks and responsibilities to the respective team members, ensuring that the right individuals or departments handle each step of the credit application process.

- Status Tracking: They enable real-time application status tracking, providing transparency to borrowers and internal stakeholders. Borrowers can monitor the progress of their applications, reducing the need for inquiries.

- Compliance Assurance: Workflow tools can be configured to enforce compliance with industry regulations and internal policies at every stage of the credit application process. This reduces the risk of non-compliance and penalties.

- Exception Handling: When exceptions or anomalies occur, workflow management tools can trigger alerts and notifications, allowing for swift resolution and preventing bottlenecks.

- Reporting and Analytics: Workflow tools often include reporting and analytics capabilities, providing insights into process performance, bottlenecks, and areas for improvement.

Automating ITSM workflows transforms the overall experience for borrowers and staff while staying aligned with organizational goals and customer needs.

How ITSM Data Analytics Assists in Risk Assessment and Decision-Making

When integrated into ITSM practices, data analytics becomes a potent asset in credit application processing. It enhances the performances of financial institutions with the ability to collect crucial insights from vast datasets, offering a multifaceted approach to risk assessment and informed decision-making:

- Risk Assessment Precision: Data analytics enables extracting and analyzing an extensive range of data points. For example, it can encompass a borrower’s credit history, financial transactions, employment history, and even macroeconomic indicators. By processing this comprehensive data, analytics models can discern intricate patterns and correlations that human evaluators might overlook. This results in a more precise risk assessment as algorithms efficiently identify potential creditworthiness or red flags.

- Credit Scoring Models: Credit scoring models, a prime application of data analytics, assign numerical scores to borrowers based on their credit profiles. These scores serve as a critical component in risk assessment. These models can identify variables and factors contributing to credit risk through historical data analysis. For instance, by examining past borrower behavior and repayment patterns, analytics can identify attributes indicative of a high-risk applicant, enabling lenders to make more informed lending decisions.

- Market Trends and External Factors: ITSM data analytics extends beyond individual borrower assessments. It also encompasses the analysis of market trends and external economic factors. By tracking and interpreting these variables, financial institutions gain valuable foresight into potential market fluctuations that may impact loan performance. This information informs lending decisions and helps institutions adapt their strategies accordingly.

- Portfolio Management: Data analytics is not confined to the approval stage alone. It plays a pivotal role in ongoing portfolio management. Financial institutions utilize analytics to monitor the performance of their loan portfolios in real-time. By continuously analyzing data on borrower behavior, credit quality, and economic trends, institutions can proactively identify and manage risks within their portfolios, optimizing the balance between risk and return.

- Customized Decision Support: ITSM data analytics provides decision-makers with actionable insights. It assists in crafting customized lending decisions based on objective data. For instance, lenders can fine-tune individual borrowers’ interest rates, loan terms, or collateral requirements based on the analytics-derived credit risk assessment.

ITSM data analytics empowers financial institutions by improving risk assessment precision, developing robust credit scoring models, providing market insights, supporting portfolio management, and enabling customized decision-making. This strengthens lending practices by enhancing accuracy and performance in credit application processing. Tools like Infraon ITSM, ServiceNow, BMC Helix, Cherwell, and Zendesk are crucial in achieving these benefits by optimizing financial operations and lending decisions.

Ensuring Financial Security and Compliance with ITSM

In today’s financial industry, security protects sensitive data, while compliance ensures adherence to industry-specific regulations. This discussion explores how ITSM contributes to these vital objectives within finance.

The significance of data security and regulatory compliance in the financial industry:

Data security and regulatory compliance are essential in the financial industry, where handling sensitive information is necessary. This discussion explores the critical significance of these two pillars within the financial sector, illuminating their role in safeguarding both financial institutions and their customers.

- Customer Trust: Financial institutions handle sensitive customer data, including personal and financial information. Ensuring the security of this data is critical to maintaining customer trust and confidence.

- Legal Obligations: The financial industry is subject to complex regulations and laws, such as the Gramm-Leach-Bliley Act (GLBA) and the Sarbanes-Oxley Act. Non-compliance with regulations can lead to severe legal and financial consequences.

- Data Breach Risks: Financial institutions are prime targets for cyberattacks and data breaches. Breaches can result in reputational damage, financial losses, and regulatory penalties.

- Market Integrity: Compliance with regulations ensures the integrity of financial markets and prevents fraudulent activities that could harm investors and the broader economy.

How ITSM Can Help Meet These Requirements

Meeting the requirements of data security and regulatory compliance in the financial industry is a challenge. This discussion will explore how ITSM solutions are vital in addressing these demands and proactively enhancing financial institution’s performance.

- Robust Security Measures: ITSM incorporates robust security protocols like access controls, encryption, and intrusion detection systems to safeguard sensitive financial data from unauthorized access or breaches.

- Compliance Frameworks: ITSM frameworks such as ITIL provide guidelines for aligning IT services with regulatory requirements. These frameworks help financial institutions establish and maintain compliant IT processes.

- Incident Management: ITSM includes incident management practices that ensure prompt detection and response to security incidents and breaches. This ensures that any violations are addressed swiftly, minimizing damage.

- Auditing and Documentation: ITSM encourages rigorous documentation and audit trails. This documentation is invaluable in demonstrating compliance with regulatory requirements during audits or investigations.

- Risk Assessment: ITSM incorporates risk assessment methodologies to identify and mitigate security risks proactively. Financial institutions can address vulnerabilities by conducting regular risk assessments before exploiting them.

- Training and Awareness: ITSM emphasizes training and awareness programs to educate staff about security best practices and regulatory requirements. Well-informed employees are essential to maintaining compliance.

Data security and regulatory compliance are non-negotiable in the financial industry. ITSM ensures that financial institutions can navigate the regulatory environment while safeguarding sensitive data and maintaining the trust of their stakeholders and customers.

Related blog: A Comprehensive Guide on ITSM Tool Evaluation and Selection

Conclusion:

ITSM’s automation and digitization have streamlined loan processing by reducing manual tasks and expediting decisions. The structured framework ensures systematic and consistent credit assessments while encouraging stakeholder collaboration. This approach enhances overall performance, accuracy, and speed in the credit approval process, making ITSM an invaluable asset in modern finance. ITSM’s role is expected to grow as technology advances in the financial industry.

Infraon ITSM stands out as a robust suite of tools and features specifically designed to meet the unique needs of the financial industry. It encourages security measures, facilitates adherence to regulatory requirements, and empowers institutions to identify and manage risks proactively. By adopting this ITSM, financial organizations can create a secure and customer-centric credit approval environment, benefiting the institutions and the borrowers they serve. As the financial industry continues to evolve, Infraon ITSM is poised to play a pivotal role in shaping the future of loan processing, ensuring that it remains adaptable and responsive to the ever-changing demands of borrowers and lenders alike.