Introduction

In finance and accounting, asset depreciation plays a crucial role in accurately reflecting the value of tangible assets over time. As we embark on a new year, businesses and individuals must understand the complexities of asset depreciation for 2025. This guide highlights the importance of asset depreciation in financial reporting, analysis, and decision-making. We will explore its impact on financial statements, profitability, investments, taxes, cost recovery, and compliance. You will learn to manage assets effectively by grasping asset depreciation’s significance.

How Does Asset Depreciation Work?

Asset depreciation refers to the systematic allocation of the cost of a tangible asset over its useful life. It recognizes that assets, such as buildings, machinery, or vehicles, gradually lose value due to wear and tear, obsolescence, or technological advancements. Depreciation is a way to account for this decrease in value and adequately reflect it on financial statements.

Related blog: The Ultimate Guide to IT Asset Management: A Step-by-Step Checklist

The Role of Depreciation in Financial Statements:

Depreciation is crucial in financial reporting, primarily in the income statement and balance sheet. In the income statement, depreciation is recorded as an expense, referred to as depreciation expense or depreciation cost. This expense represents the portion of the value of an asset used up during a specific period.

The depreciation on the balance sheet is deducted from the asset’s original cost to determine its carrying or net book value. Carrying value represents the asset’s current worth after accounting for the accumulated depreciation over its useful life. The balance sheet provides a more accurate depiction of the actual value by deducting accumulated depreciation.

Impact of Depreciation on Taxes and Profitability:

Depreciation has significant implications for both taxes and profitability. Firstly, depreciation offers tax benefits by reducing taxable income. Businesses can deduct depreciation expenses from their taxable income in many jurisdictions, resulting in lower tax liabilities. This deduction helps to align tax payments with the actual wear and tear or decline in the value of the assets.

Secondly, depreciation affects profitability assessments. When depreciation expenses are deducted from revenue, it reduces the net income in the income statement. This reduction in net income reflects the actual cost of using the assets during the period. By factoring in depreciation, you can accurately evaluate your organization’s profitability, considering the expenses associated with asset utilization.

Moreover, depreciation impacts financial ratios and performance indicators. For example, the return on assets (ROA) ratio considers the net income generated relative to the total assets employed in the business. Depreciation affects the total assets by reducing the carrying value of the assets, thus influencing the ROA ratio. Similarly, other profitability ratios and metrics are influenced by accurately recognizing depreciation expenses.

Different Methods of Asset Depreciation

Different methods exist for calculating depreciation, each offering a different approach to spreading the cost and reflecting the decrease in asset value. This section will explore three commonly used methods of depreciation: the straight-line method, the declining balance method, and the Sum of the Year’s digits.

Straight-Line Method:

The straight-line method evenly spreads the cost of an asset over its useful life, resulting in a consistent annual depreciation expense. This method calculates the depreciation by dividing the difference between the asset’s cost and salvage value by its useful life. The salvage value represents the asset’s estimated residual value at the end of its life. The formula for calculating depreciation using the straight-line method is:

Depreciation Expense = (Asset Cost – Salvage Value) / Useful Life

Let’s consider an example to understand this method better. Suppose a company purchases a piece of machinery for $50,000. The machinery is expected to have a life of 10 years, and its salvage value is estimated to be $5,000.

Using the straight-line method, we can calculate the annual depreciation expense as follows:

| Assets Costs | $50,000 |

| (-) Salvage value | $5,000 |

| Net Assets value after salvage value | $45,000 |

| Total Useful years | 10 Years 0 |

| Depreciation Expense = (Asset Cost – Salvage Value) / Useful Life ($50,000 – $5,000) / 10 | $4,500 per Year |

In this example, the company will record a yearly depreciation expense of $4,500 for the next ten years. By spreading the cost evenly over the life of the machinery, the company accurately reflects the gradual decrease in its value on its financial statements.

The accumulated depreciation equals the assets cost minus salvage value, reflecting the remaining value. The straight-line method offers a simple and consistent approach suitable for assets with linear depreciation. Alternative methods like declining balance or units-of-production may be more appropriate for assets depreciating rapidly initially. Overall, the straight-line method ensures consistent minimization and accurate reflection of value decrease over time.

Declining balance method:

The declining balance method is an approach for asset depreciation that allows for higher expenses in the early years. It uses a fixed depreciation rate applied to the carrying value: the assets cost minus accumulated depreciation. This method recognizes the accelerated decline in value. The formula for calculating depreciation using the declining balance method is:

Depreciation Expense = Opening Book Value * Depreciation Rate

Where, Opening Book Value = Asset Value – Depreciation

Let’s consider an example to understand the declining balance method better. Suppose a company purchases a piece of machinery for $50,000 with an estimated life of 5 years and no salvage value. Using the declining balance method, the depreciation rate would be twice the straight-line rate of 20% per Year (100% divided by the useful life).

Opening Value of Assets

| Opening Value of Assets | Depr Rate | Depr Expenses | Amount after depr | Accumulated Depr | Closing Value of Assets |

| $ 50,000 | 40% | $20,000 | $30,000 | $20,000 | $30,000 |

| $ 30,000 | 40% | $12,000 | $18,000 | $32,000 | $18,000 |

| $18,000 | 40% | $7,200 | $10,800 | $39,200 | $10,800 |

| $10,800 | 40% | $4320 | $6,480 | $43,520 | $6,480 |

| $6,480 | 100% | $6,480 | —– | $50,000 | —– |

The declining balance method front-loads depreciation expenses with rapid decline, gradually decreasing until the asset’s life ends or its salvage value is reached. For assets with slower depreciation, other methods may be more appropriate. Overall, this approach provides a more accurate representation of specific asset depreciation patterns.

Sum-of-Years Digits (SYD) Depreciation Method:

The Sum-of-Years Digits (SYD) depreciation method is an accelerated depreciation technique that allocates higher depreciation expenses to the early years of an asset’s life. It follows the principle that assets lose value more rapidly in their initial years. The formula for calculating depreciation using Sum-of-Years Digits (SYD) Depreciation is:

Depreciation for the Year = (Asset Cost – Salvage Value) × Yearly factor

Where, 1st Year Factor = n / 1+2+3+…..+n (Upto assets life) *100

2nd Year Factor= n-1/ 1+2+3+…..+n(Upto assets life) *100

3rd Year Factor= n-2 / 1+2+3+…..+n (Upto assets life) *100

Let’s consider an example to understand the Sum-of-Years Digits method better. Suppose a company purchases a piece of machinery for $50,000 with an estimated life of 5 years and no salvage value. Using the Sum of the Year’s digit method.

| Beginning of the Year | Yearly Factor 1+2+3+4+5= 15 | Depr % | Depreciation Amount | Accumulated Depr Amount | Ending Value of the Assets |

| $50,000 | (5/15)*100 | 33.33 | $16,667 | $16,667 | $33,333 |

| $33,333 | (4/15)*100 | 26.67 | $13,333 | $30,000 | $20,000 |

| $20,000 | (3/15)*100 | 20 | $10,000 | $40,000 | $10,000 |

| $10,000 | (2/15)*100 | 13.33 | $6,665 | $46,667 | $3,333 |

| $3,333 | (1/15)*100 | 6.67 | $3,333 | $50,000 | —— |

As depicted in the table, each Year’s depreciation expense is calculated based on the remaining useful life and a yearly factor derived from the Sum of the digits representing the years of useful life (1+2+3+4+5….+n = 15). At the beginning of Year 1, the asset’s original value is $50,000, and the depreciation percentage is (5/15) * 100, resulting in a depreciation amount of $16,667 for that Year. As time progresses, the depreciation expenses decrease due to the assets diminishing helpful life. By the end of Year 5, the accumulated depreciation reaches the asset’s original value, indicating that the asset has been fully depreciated and its value stands at zero.

Using the Sum-of-Years Digits depreciation method, the computer’s depreciation expenses are higher in the early years and decrease gradually over time. This approach gives businesses a more accurate representation of an asset’s diminishing value, making it easier to plan for replacements, optimize tax benefits, and manage financial resources effectively.

Calculating Asset Depreciation:

Asset depreciation is a fundamental aspect of financial management for organizations. Depreciation allows entities to spread the cost of tangible assets over their useful lives, providing a more accurate representation of an asset’s value as it ages. This comprehensive guide offers a various-step approach to calculating asset depreciation.

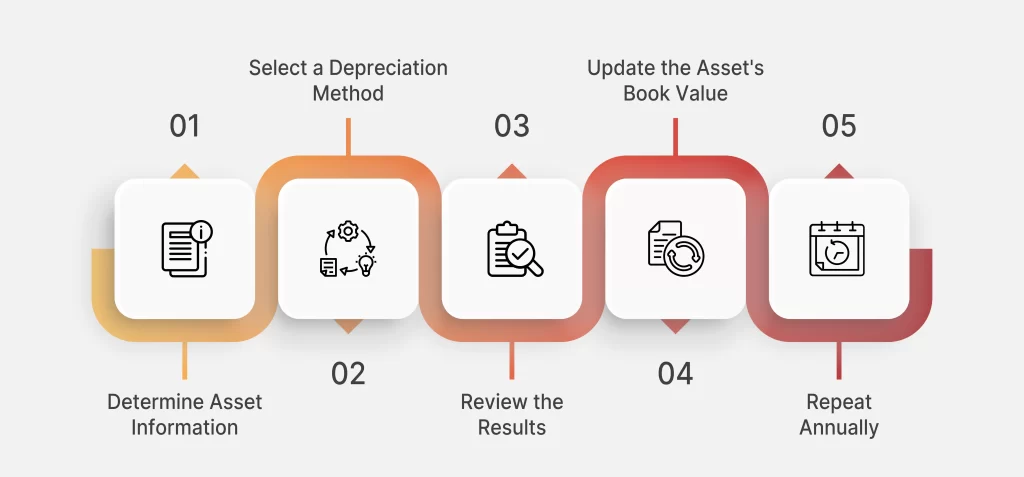

Steps to Calculate Depreciation:

- Determine Asset Information: Gather essential details about the asset, including its original cost, estimated useful life, and expected salvage value.

- Select a Depreciation Method: Choose the most appropriate depreciation method based on the asset’s characteristics and your organization’s accounting policies. Standard methods include straight-line, declining balance, and sum-of-years digits.

- Review the Results: Once you have calculated the annual depreciation expense for each year, review the figures to ensure accuracy and consistency with the chosen depreciation method.

- Update the Asset’s Book Value: Subtract the annual depreciation expense from the asset’s book value each year to obtain the new book value for the following Year.

- Repeat Annually: Continue the depreciation calculation process for each subsequent year until the asset’s useful life ends or its book value reaches the salvage value.

Remember, proper asset depreciation calculation is crucial for financial reporting, tax planning, and making informed asset management and replacement decisions. It is recommended to consult an accountant or financial professional to ensure accurate and compliant depreciation practices for your organization.

Different Types of Asset Depreciation

Understanding how to depreciate different assets accurately is essential for precise financial reporting and strategic decision-making. Let’s explore the depreciation considerations for various asset categories:

- Buildings and Real Estate: Buildings typically have a long life and are subject to depreciation methods like straight-line or declining balance, depending on their expected economic life and the organization’s accounting policies. However, land does not depreciate as its value is to be perpetual.

- Machinery and Equipment: Machinery and equipment can have varying life spans depending on their type and application. Depreciation for these assets is commonly calculated using straight-line or declining balance methods. In some cases, accelerated depreciation methods like the sum-of-years digits might be more suitable, especially when the assets experience higher wear and tear in the initial years.

- Vehicles: Vehicles like cars and trucks are subject to depreciation due to usage and wear. Vehicle depreciation is calculated using straight-line or declining balance methods, depending on the estimated useful life and accounting policies.

- Furniture and Fixtures: Furniture and fixtures are depreciated using the straight-line method, as they typically have moderately valuable life and experience consistent wear and tear.

- Technology and Electronics: Technology assets, like computers and electronics, often have a shorter life due to rapid technological advancements. Depreciation for these assets is commonly calculated using straight-line or declining balance methods, reflecting their shorter life cycles.

- Intangible Assets: Intangible assets, such as patents, trademarks, and copyrights, have definite useful lives and are subject to depreciation or amortization. The depreciation method for intangible assets depends on their specific characteristics and legal lifespan.

Depreciation varies based on asset type, with unique, valuable lives, wear characteristics, and economic factors determining the appropriate method. Accurate depreciation enables transparent records, optimized tax planning, and informed asset decisions. Consult professionals to ensure compliance and select the suitable approach for each asset category.

Why is Depreciation Calculation Important in Asset Management Products?

Accurate depreciation calculation is vital in asset management products as it ensures transparent financial reporting, aids in asset value preservation, and guides strategic decision-making processes. By understanding the actual value of assets and their depreciation over time, businesses can optimize resource allocation and foster long-term financial success. Depreciation calculation is essential in asset management products for several reasons:

- Financial Reporting: Depreciation is a critical component of financial reporting, especially for companies that own tangible assets (e.g., buildings, machinery, equipment). By calculating depreciation, businesses can accurately reflect the gradual decrease in the value of their assets over time. This is crucial for preparing accurate financial statements, including the balance sheet and income statement.

- Tax Purposes: Depreciation is often used to determine the tax deduction associated with the wear and tear of tangible assets. Governments typically allow businesses to deduct depreciation expenses from their taxable income, reducing their tax liability. Accurate depreciation calculations are necessary to comply with tax regulations and optimize tax benefits.

- Asset Valuation: Depreciation affects the value of assets over time. Knowing the current value of assets is essential for making informed decisions about their usage, replacement, or sale. Asset management products that calculate depreciation can provide up-to-date asset valuations, helping businesses optimize their asset portfolios.

- Budgeting and Planning: Businesses must plan for future capital expenditures and replacements. Depreciation help in estimating the expected costs of replacing or maintaining assets. This, in turn, allows companies to budget effectively and avoid unexpected financial strains.

- Compliance and Auditing: Companies must adhere to accounting standards and undergo regular audits in regulated industries. Accurate depreciation calculations ensure compliance with accounting principles and provide transparent records for auditing purposes.

Asset Management Tools with Depreciation Calculation Support

Asset management products that support depreciation calculation come in different forms, ranging from simple spreadsheets to sophisticated enterprise-level software. Some examples include:

- Accounting Software: Many accounting software solutions include built-in depreciation modules that can automatically calculate and track the depreciation of assets over time.

- Enterprise Asset Management (EAM) Software: EAM software is designed to manage assets throughout their life cycle. These systems include depreciation functionality and features like maintenance scheduling, inventory tracking, and work order management.

- Fixed Asset Management Software: These specialized tools focus on managing and tracking fixed assets. They usually have robust depreciation capabilities to handle various depreciation methods and tax regulations.

- Cloud-Based Asset Management Platforms: Cloud-based asset management platforms provide depreciation calculation as part of their comprehensive asset tracking and management features.

- Integrated Enterprise Resource Planning (ERP) Systems: Many ERP systems incorporate asset management modules that handle depreciation alongside other business processes like finance, procurement, and HR.

In summary, depreciation calculation is crucial for financial and tax reporting, asset valuation, budgeting, and compliance. Asset management products that include depreciation functionality help businesses streamline asset-related processes, make informed decisions, and maintain accurate financial records.

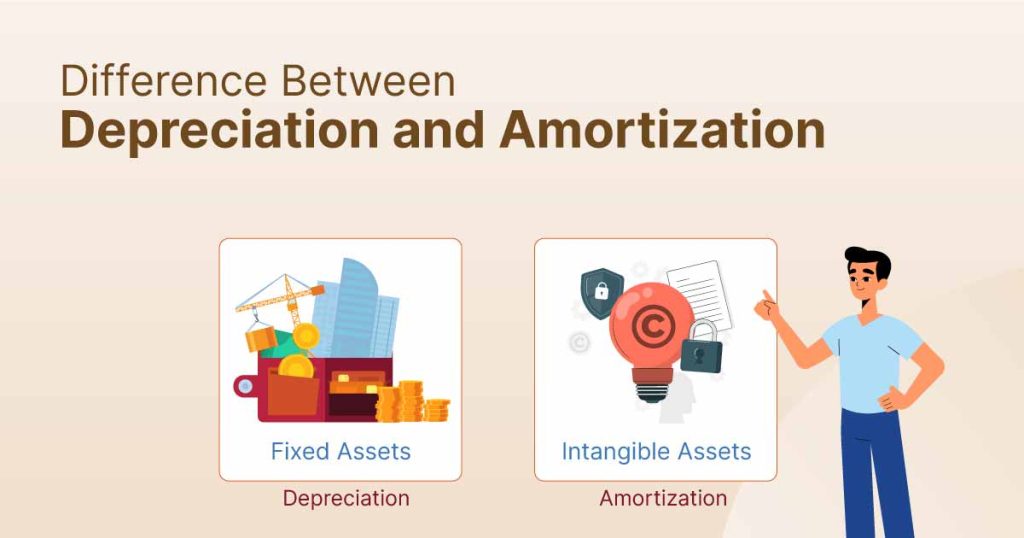

Asset Depreciation vs. Amortization: Understanding the Difference

Depreciation and amortization are separate accounting concepts that allocate asset costs over their lives. They address tangible and intangible assets, each with unique accounting treatments. Let’s explore examples of assets subject to amortization.

- Asset Depreciation: Depreciation allocates the cost of tangible assets, such as buildings, machinery, vehicles, and equipment, over their lives. It represents the decrease in the value of these assets due to wear and tear, obsolescence, or physical deterioration. Depreciation is calculated using various methods, including straight-line depreciation, declining balance, or units-of-production.

For example, let’s consider a company that purchases a piece of machinery for $50,000, with an estimated useful life of 10 years. Using the straight-line depreciation method, the annual depreciation expense would be $5,000 ($50,000 / 10 years). This means the company would spend $5,000 yearly for ten years until the machinery’s value is fully allocated.

- Asset Amortization: Asset Amortization pertains to allocating the cost of intangible assets over their lives. Intangible assets include patents, copyrights, trademarks, goodwill, and software. Unlike tangible assets, intangible assets do not have a physical form but possess long-term value for the business. Amortization allows companies to recognize the expense of acquiring and developing these assets over time.

For instance, consider a company that purchases a patent for a new technology for $100,000, with a legal life of 20 years. Using the straight-line amortization method, the annual amortization expense would be $5,000 ($100,000 / 20 years). The company would then recognize this expense on its income statement over the 20-year life of the patent.

While depreciation and amortization are both methods of allocating the cost of assets, depreciation is used for tangible assets with physical substance, and amortization is applied to intangible assets and certain deferred charges. Properly accounting for these expenses is crucial for businesses to accurately reflect their financial performance and maintain compliance with accounting standards.

Tracking and Reporting Asset Depreciation: Ensuring Accurate Financial Records

Accurate tracking and reporting of depreciation are pivotal in maintaining transparent and reliable financial records for businesses. This process involves various essential steps that collectively ensure the proper allocation of asset costs and the recognition of their decreasing value over time.

The first step in this process is the meticulous identification of tangible assets owned by the company. These tangible assets encompass various items, from office buildings and production machinery to vehicles and computer equipment. Businesses establish a solid foundation for their depreciation tracking and reporting efforts by compiling an accurate inventory of these assets.

Once the tangible assets are identified, their relevant details are recorded precisely. This includes noting the purchase date, original cost, estimated useful life, and selected depreciation method for each asset. These details serve as vital reference points throughout the asset’s lifespan and are crucial for accurately calculating the depreciation expense associated with each asset.

Accurate record-keeping ensures consistent and reliable depreciation calculations. It builds confidence when presenting financial statements to investors, creditors, and regulators. Transparent reporting offers insights into asset management, financial health, and long-term sustainability. Businesses can make informed decisions while stakeholders gain a comprehensive understanding. This fosters trust, enhancing the organization’s reputation and positioning for success.

Related blog: Importance of Tracking Software Licenses with IT Asset Management Software

Conclusion

Understanding and applying proper asset depreciation practices are essential for accurate financial records and informed business decisions. Diligently tracking and reporting depreciation fosters trust among stakeholders and enhances reputation. Implementing this knowledge in businesses brings benefits like improved financial planning, enhanced asset management, and a deeper understanding of financial health. Accurate record-keeping and transparent reporting are essential to long-term success.

By embracing these practices, businesses commit to financial integrity and long-term success. Proper asset depreciation is a compliance requirement and a strategic tool for optimizing resources, planning, and strengthening relationships with investors and creditors. These principles ensure a more robust business foundation, fostering steady growth and resilience in a dynamic market. Let’s strive for accurate asset depreciation as an integral part of responsible financial management.